What Documents Do I Need to Refinance a Car Loan?

Refinancing a car loan requires you to provide a lot of documentation to the lender. Before starting the application process, you’ll need to pull the necessary documents together. If you’re not sure where you have this information filed away, don’t worry. You can easily request the documents needed to refinance a car loan from the people who initially issued them (your employer, insurance company, etc.).

Keep in mind that each lender will require slightly different documents as part of the car loan refinance application process. Several factors related to your unique situation may also dictate that specific documents may be required. These factors may include:

- Your credit score

- Your type of income

- The terms of the proposed loan

- Whether you are adding or deleting a cosigner on the loan

In general, you will need to provide the following documents to the lender when you refinance a car loan:

- Proof of income

- Proof of residence

- Proof of insurance

- Vehicle information

- Current loan information

Proof of Income

Lenders will want proof of income when evaluating your car loan refinance application. They will use your income information to calculate your payment-to-income ratio, which is a crucial aspect of assessing your risk as a borrower. Before approving your application, the lender will want to be confident that you have the financial means to make your monthly payments.

In some instances, you’ll be asked to provide pay stubs, W-2 tax forms and/or tax returns as proof of income. Your type of employment will dictate the type of documents you’re required to provide:

- Salary/Hourly Employees – You will most likely need to provide pay stubs for at least the two most recent pay periods prior to your application submission. If you’re applying to refinance at the beginning of the year, you may also be asked to provide a W-2 from the previous year.

- Contract/Freelance Employees – Most freelance and contract employees receive multiple 1099 forms, which can make it harder to demonstrate consistent income over the course of a year. To simplify the process, you will most likely be asked to provide your tax returns instead.

- Self-Employed Individuals – If you are self-employed, you will most likely be required to provide tax returns from the previous two years.

You can request copies of your W-2 from your employer. If you need to provide tax returns, you can request these online via the IRS website. If you have supplemental forms of income from side gigs, you should provide this income information to the lender as well. It may demonstrate a greater ability to make your monthly payments, which will help your application.

Proof of Residence

You can demonstrate proof of residence with a variety of documents, including:

- Utility bills

- Bank statements

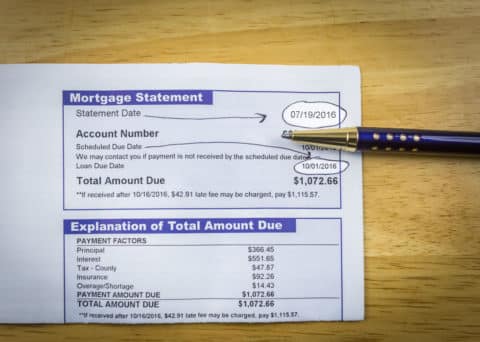

- Mortgage statement or lease agreement

- Homeowners or renters insurance policy

- Property tax bill

Proof of Insurance

You’ll need to provide the lender with proof of auto insurance. This can be documented by your insurance ID card or your declarations page from your insurance company. Depending on the amount of your loan, the lender may require that you carry a certain level of coverage to ensure the loan can be paid off in the event that the vehicle is totaled in an accident.

Vehicle Information

You’ll need to provide the following vehicle information when you apply to refinance a car loan:

- Driver’s license

- Year, make and model of the vehicle

- Registration information

- Vehicle identification number (VIN)

- Vehicle mileage (this can be demonstrated with an odometer photo)

Current Loan Information

The lender will want to see the following information about your existing car loan:

- Payoff balance

- Name of lender

- Interest rate you’re paying

- Amount left on your loan term

- Current monthly payment

iLending Makes Providing this Documentation Easy and Hassle Free

Compiling the necessary documents for your refinance is pretty straightforward. If you are well organized, this should only take a few minutes. When you work with iLending, we make the process of getting those documents to us easy and hassle free. Our online portal provides a safe, easy way for you to upload your documents, making the process as smooth as possible.

We’ve created a unique You First Approach™ to ensure you have a great experience throughout every stage of the process. Once you apply to refinance your car loan, you’ll be paired with a personal loan consultant who will utilize our relationships with over 50 nationwide lenders to identify the best loan options which address your specific goals. Your loan consultant will walk you through the entire application process and provide assistance at every stage.

On average, our clients are able to save $145/month when they refinance their car loan with iLending. This savings can provide a much-needed infusion of cash into your monthly budget, allowing you to experience greater financial freedom moving forward.

Apply now to get the car loan refinance process started.